Objective

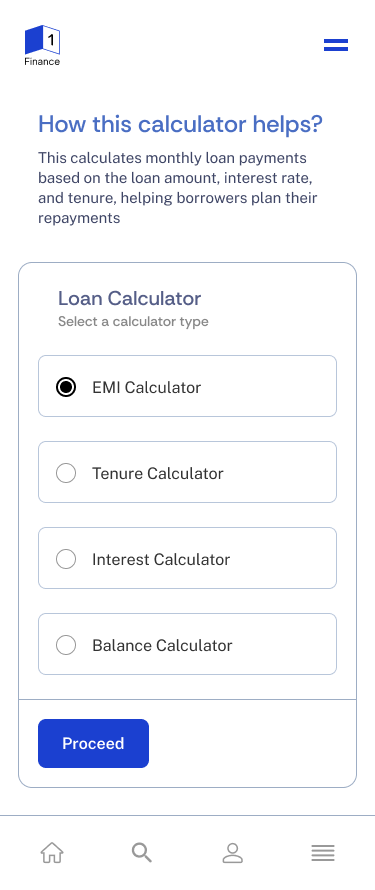

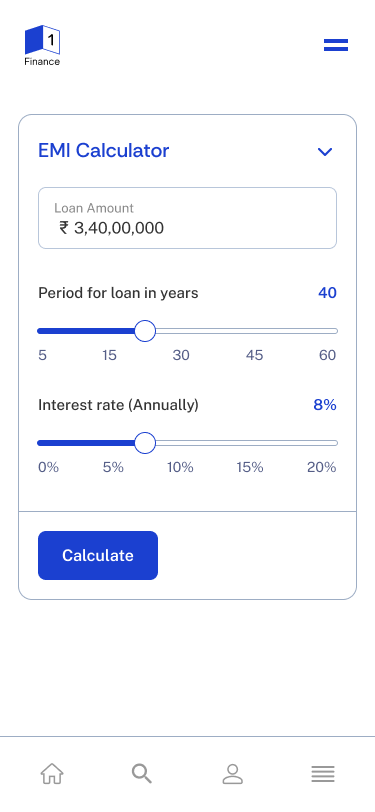

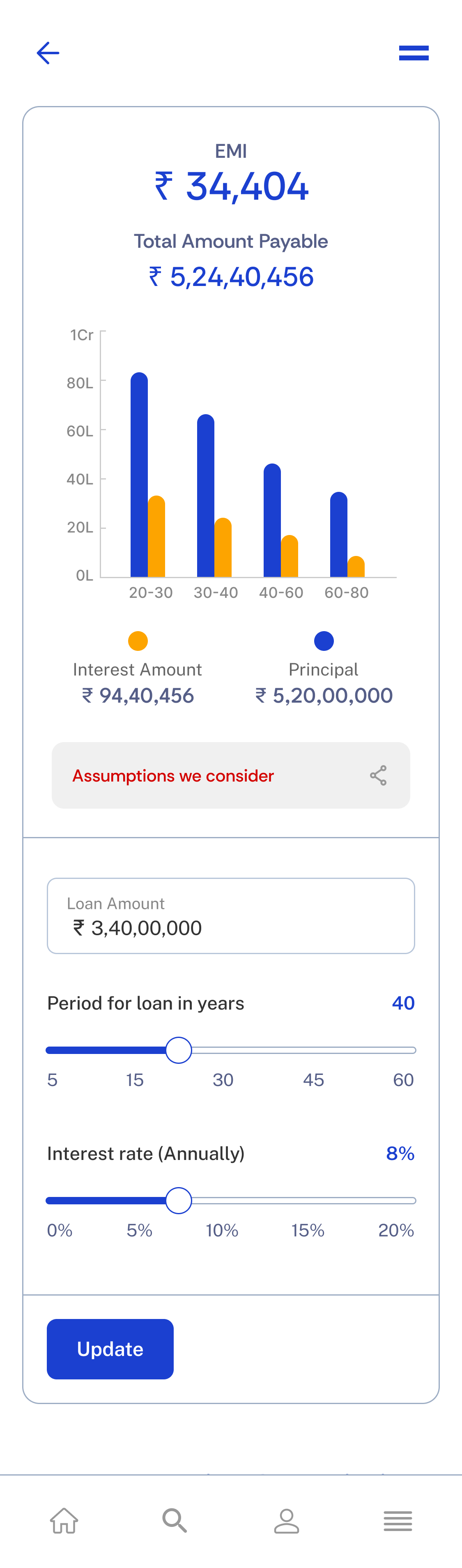

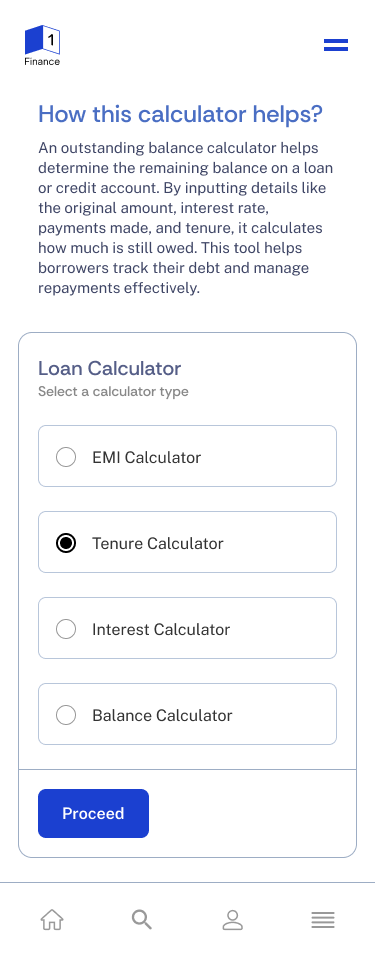

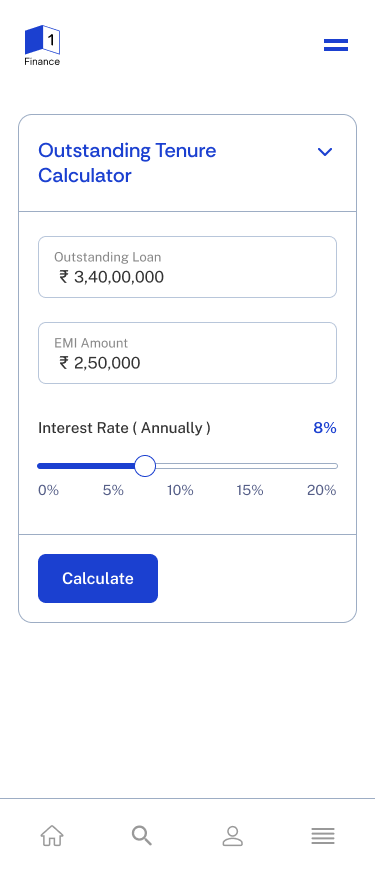

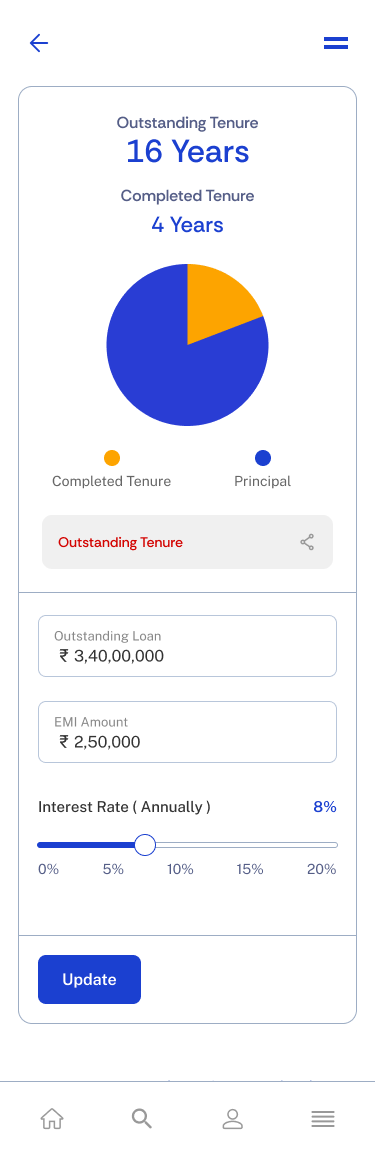

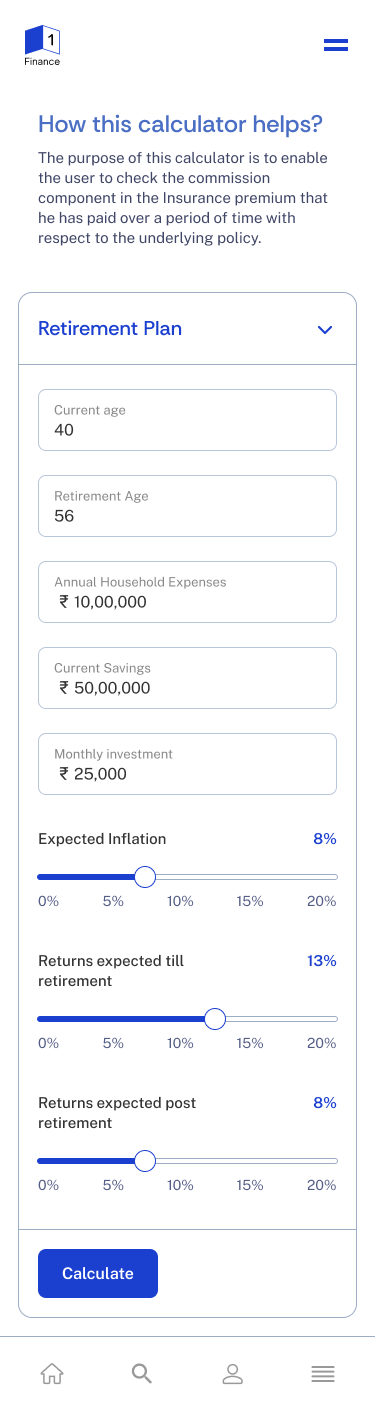

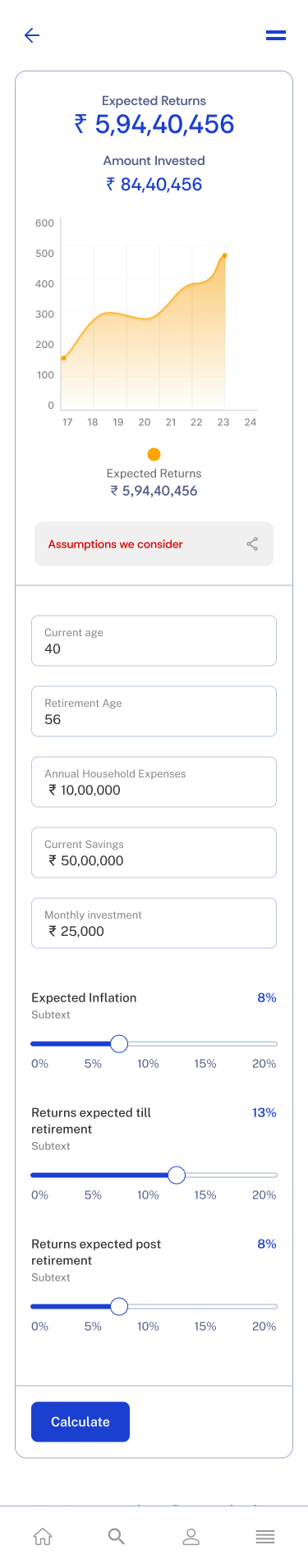

Design and integrate new financial planning features ( ie : EMI Calculator, Tenure Calculator, Retirement Planner, and Portfolio Analysis ) into the existing app by mapping workflows and user flows to ensure seamless incorporation into current journeys without disrupting usability. Deliverables include high-fidelity wireframes and developer handoff.

User Research

Understanding the user needs

The target audience for 1Finance includes:

- Young professionals (ages 22-35): They are tech-savvy, open to financial planning tools, and value quick, actionable insights.

- Middle-aged users (ages 36-50): Primarily concerned with long-term planning (e.g., retirement) and more complex financial products (e.g., loans, investments).

- Retirees (ages 50+): Looking for retirement planning, budgeting, and portfolio assessment tools.

Pain points to address

- Most financial apps are either too basic or overly complex. Users often feel overwhelmed.

- People often struggle with understanding their finances without expert advice.

- Multiple apps for loan management, retirement planning, and portfolio assessment lead to confusion and inefficiency.

- Many finance tools don’t provide optimized mobile experiences for on-the-go financial planning.

Delivered Solution

- Delivered a seamless integration of financial planning features into the existing workflow without disrupting current user journeys.

- Created reusable and scalable components to support future features and maintain flexibility in design and ensured that it is aligned with existing design guidelines for a unified experience across the app

- Delivered high-fidelity wireframes, interactive prototypes, and well-documented specifications to enable a smooth handoff to the development team